Table of Content

The HOLC stopped its lending activities in June, 1936, by the terms of the Home Owners' Loan Act. The historian David Kennedy did not exaggerate in claiming that the HOLC and the housing legislation it set in motion "revolutionized the way Americans lived." Diminished wages, widespread unemployment, and few, if any, refinancing options made it difficult for home owners to meet monthly mortgage payments during the Great Depression.

The urban reformer Charles Abrams pointed out that, on average, the HOLC refinanced the mortgages it purchased for only 7 percent less than the previous, admittedly inflated, value of the property in question . The HOLC, for example, might refinance a $10,000 mortgage as if the initial amount loaned to the home owner had been $9,300, but that figure—$9,300—could still be significantly higher than the current deflated market value of the property. Under this arrangement, lenders only had to forego a small part of their capital, plus they received government-backed bonds in place of frozen mortgages. On the other hand, by propping up the face values of its refinanced mortgages, the HOLC compelled home owners to repay inflated 1920s mortgage loans with deflated 1930s wages.

Home Owners Loan Corporation (HOLC)

Consequently, the term of the loan could not change unless the loanee did not pay the loan. Due to the fact that HOLC obtains loans by providing a bond value equal to the amount of principal owing by the borrower, most of the lenders have benefited from the sale of their loans. This is because of the high-interest rate which if not paid at the right time, accumulates. Home Owner’s Loan Corporation was established to help manage this situation. Before the pandemic devastated minority communities, banks and government officials starved them of capital.

Unfortunately, there was an enormous real estate bubble that surfaced which affected both the banks, government and home buyers. This led to a crash in the stock market nine years later, leading to great Depression. The core aim of the Home Owners Loan Corporation is to provide emergency relief with respect to home mortgage indebtedness. Going for loans is quite easy and helpful, but the repaying process has always posses as a daunting task for many, especially if it’s a long-term loan. The Harry S. Truman Library and Museum is part of the Presidential Libraries system administered by the National Archives and Records Administration, a federal agency. On April 13th, 1933, President Roosevelt sent a message to Congress requesting legislation that would protect homeowners from foreclosure.

Does the FHA still exist today?

HOLC also assisted mortgage lenders by refinancing problematic loans and increasing the institutions' liquidity. The HOLC issued bonds and then used the bonds to purchase mortgage loans from lenders. The loans purchased were for homeowners who were having problems making the payments on their mortgage loans "through no fault of their own".

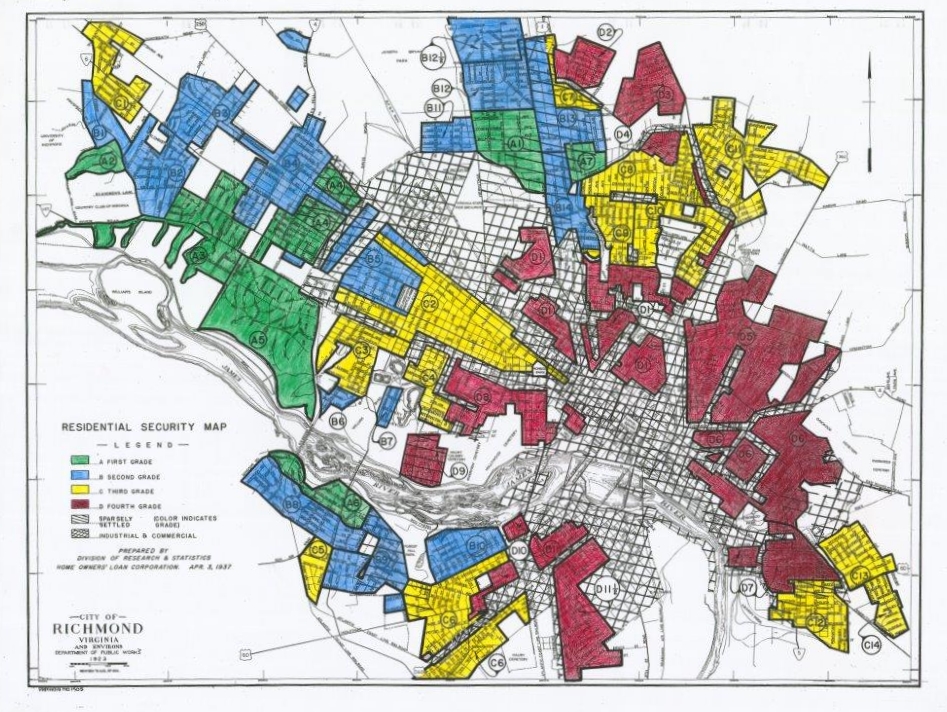

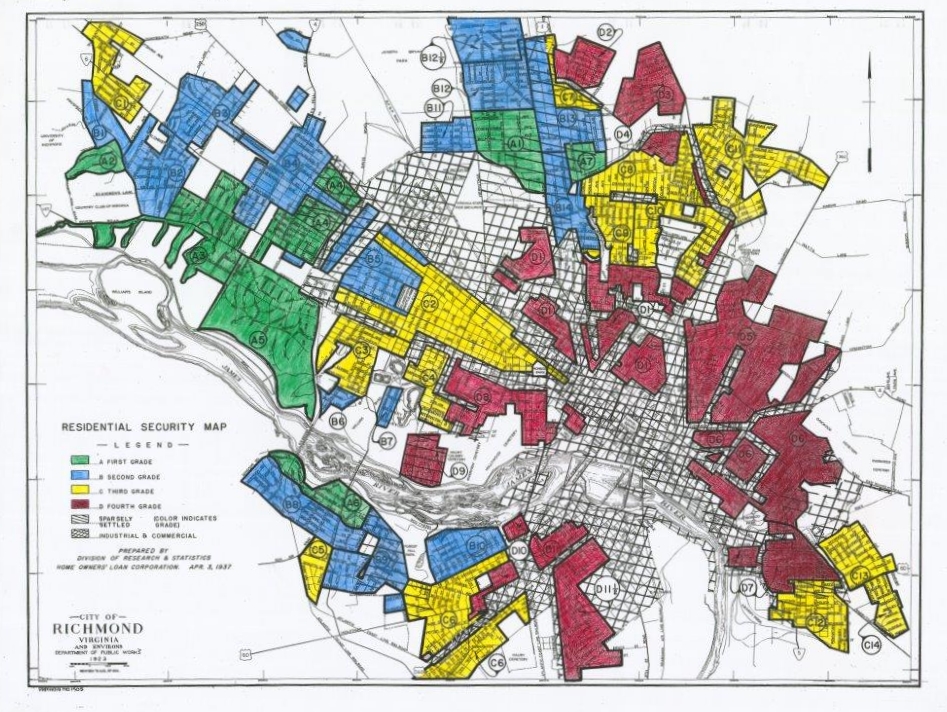

HOLC was officially shut down in 1951, after its last assets were transferred in 1951 to lenders from the private sector. These questions are approached through the spatial analysis of the HOLC map archive, and the degree to which the old grading corresponds with current neighborhood economic and racial/ethnic status. This is then compared with overall city-level indicators of segregation and economic inequality.

Did the HOLC refinanced mortgages?

A study released in 2018 found that 74 percent of neighborhoods that HOLC graded as high-risk or "hazardous" are low-to-moderate income neighborhoods today, while 64 percent of the neighborhoods graded "hazardous" are minority neighborhoods today. “It’s as if some of these places have been trapped in the past, locking neighborhoods into concentrated poverty,” said Jason Richardson, director of research at the NCRC, a consumer advocacy group. There is significantly greater economic inequality in cities where more of the HOLC graded high-risk or “Hazardous” areas are currently minority neighborhoods. To a lesser extent this is also true of cities where more of the HOLC low-risk or “Desirable” areas have remained white. This could indicate that cities with less change in the racial and ethnic structure of their neighborhoods over the past 80 years have greater economic inequality today. The corporation was established in 1933 by the Home Owners’ Loan Corporation Act under the leadership of President Franklin D. Roosevelt.

Far from "ironically" issuing a few loans to African-Americans in an "initial phase" and then becoming a major promoter of redlining, HOLC actually refinanced mortgage loans for African-Americans in near proportion to the share of African-American homeowners. The pattern of loans had basically no relationship to the "redlining" maps because the program to create the maps did not even begin until after 90% of HOLC refinancing agreements had already been concluded. As for private lenders, though Kenneth T. Jackson's claim that they relied on the HOLC's maps to implement their own discriminatory practices has been widely repeated, the evidence is weak that private lenders even had access to the maps. By contrast, it is well documented that private lenders understood which neighborhoods the FHA favored and disfavored; suburban greenfield developers often explicitly advertised the FHA-insurability of their properties in ads for prospective buyers.

Related Legal Terms

Some scholars have argued that the maps and codification of appraisal practices introduced by the HOLC bolstered “redlining” as a pattern in government mortgage lending (Jackson 1987; Massey and Denton 1993). From this evidence it appears that the residential security maps were not used by the HOLC to qualify mortgage refinancing; however, it is unclear to what degree the maps may have been used later, by FHA appraisers. Greer’s 2014 analysis extends beyond the HOLC maps themselves to encompass later FHA mortgage risk maps of Chicago, finding that those maps directly impacted lending decisions, barring loans over larger sectors of the city.

By that time, the HOLC had made 1,021,587 loans, making it the owner of approximately one-sixth of the urban home mortgage debt in the United States. The HOLC's operations were not officially terminated until February 3, 1954. Eighty years ago, a federal agency, the Home Owners’ Loan Corporation , created “Residential Security” maps of major American cities.

The minority of home buyers who could manage such terms assumed the additional risk of dealing with local institutions that did not offer loan mortgage insurance and were often dangerously under-funded, especially in areas outside the main cities. They also use some of their bonds to buy mortgage loans from lenders. The loans acquired were for borrowers who had trouble making payments on their mortgage loans “through no fault of their own” The HOLC then refinanced the loans to the creditors.

Housing continued to be a problem for African Americans, and in fact, grew worse during the Depression. Feagin wrote that “New Deal housing programs increased residential segregation areas by restricting the new federally guaranteed home loans to homes in segregated areas and by locating public housing so that it would be segregated” (p. 58). HOLC typically acquired distressed mortgages by giving lien holders government insured bonds, then would make new loans to home owners – loans that could be repaid over a longer period of time and at low interest rates (5% or less) .

In response, Congress rapidly created the Home Owner's Loan Corporation. The HOLC agency was established in the context of the FDR’s New Deal Programs that encompassed his plans that included Relief, Recovery and Reform to fight the problems and negative effects caused by The Great Depression. HOLC also supported the mortgage industry by refinancing difficult loans and also increasing the institution’s liquidity. The HOLC was unable to make loans in the future and focused instead on repayments of loans. It is important to note that the B&L was a direct reduction loan where certain amounts of principal was due every month.

No comments:

Post a Comment